End of an Era: Coffee Market Back in Carry

- Ryan Delany

- Nov 15, 2022

- 7 min read

The current Z/H #calendarspread has been inverted for an entire year (November 2021) and today, it touched a low of -2.6c and is currently trading @ -1.8c.

The collapse of the inversion has been swift and violent, but more significantly, it opens the door for the final phase of the current Bear market in #coffee.

What Happened and Why it Matters

#Arabica is a market that is notoriously difficult to invert, which makes the 1 year long inversion all the more remarkable.

However, #coffeefutures are now back in #contango, after an impressive drop in spreads over the last 4 weeks. The front month Z/H dropped from a high of +10 to +4 in just 1 week, consolidated to +2c over the next 2 weeks and then collapsed to a low -2.6c in just 3 days. This dramatic reversal was enabled by the sudden change of course in the #certifiedinventory.

[Hey, nice to see you again. We should do this more often. Sign up for a premium subscription here and we can do this every week!]

Calendar spreads are a function of certified inventory, especially when stocks become very low. And certified inventory levels were indeed very low.

Cert stocks fell to below 400k bags, these were levels not seen since the late 1990s when stocks ultimately fell below 1k bags. For a market that typically holds between 1 million and 2 million bags this was a doomsday scenario. When the certs hit these critical levels in the 1990s, calendar spreads went to plus 50c!

The combination of low cert stocks, and the steep trend of drawdown made for a powerful bullish combination.

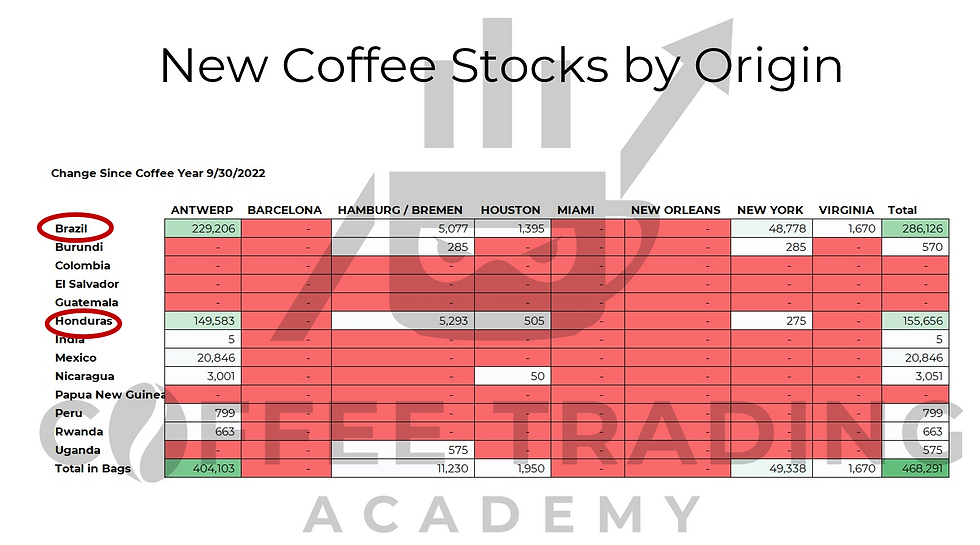

However, over the last several weeks we have seen not only an addition of 85.5k new certified stocks (last 7 sessions), but an enormous and growing volume of stocks pending certification. These "pending" stocks currently exceed half a million bags (541k today), and are even larger than the total certs volume itself (468k).

This volume has made the market anticipate a healthy build up in certs that’s collapsing spreads.

There is yet some mystery as to source of these certs as we are far from tenderable parity, so it is not economically viable to buy new coffees and sell them as futures. They could be new crop or recerts, or new certifications of old coffees, not just washed #Brazil coffees but #Honduran coffees too. Regardless of the source, if these are old crop coffees they were selected with higher cup qualities, which would justify the high passing rate of ~78%.

From CTA Daily Certified Stock Report

Why is this Surprising?

Everyone knew that if the certified inventory increased it, it would collapse the calendar spreads, but predicting it is murky.

There is only one type of entity that is practically capable of certifying coffee to the exchange, and that is the trade. The trade had every incentive for certified coffee to increase and for spreads to collapse because an inverted market is a huge cost for them and threatens their existence.

This is because the trade makes their living by holding hedged inventory.

[Taking a look at these reports I see. Excellent choice, I might add. Why not take it for a spin? Try a free trial of our premium subscription so that you can see what this baby can do on the road.]

Many people think that traders want to buy low and sell high, but that is not exactly true. The trade transfers coffee from producers to consumers by buying when futures prices are high and selling to consumers when prices are low. This is only possible through hedging.

Typically a commodity market in carry means that the trade receives a payment every roll period that covers the inventory costs of warehousing, financing, insurance, etc. In an inverted market, the trade not only loses this reimbursement for carrying coffee, but it is also essentially charged a fee that increases their warehousing costs. With a 10c inversion, the trade not only pays their warehouse cost, but also an additional charge of about 3 times warehousing costs just to hold hedged coffee!

This is very expensive for the trade, they are not set up to handle it and it can ultimately put them out of business. They therefore had every incentive to collapse the spreads, and the only way to do that, is to increase certified inventory.

However, despite this incentive, calendar spreads remained inverted for a very painful year. So why now?

Until recently, high freight costs and high differentials had put the trade between a rock and a hard place. They were forced to consume coffee from the certified inventory because it was even more expensive elsewhere. This changed with the improvement of logistics and the availability of coffee from the Brazil 2022 crop and now the October 22 crop hedgeflow.

It is difficult to say exactly when new coffees will be certified because there are several large trade houses capable of certifying coffee and it is up to their individual incentives as to when to certify.

The main calculation done to anticipate whether we will see new coffees certified is #tenderableparity. Tenderable parity is the breakeven price where it becomes viable to buy new crop coffee and deliver against a #future. Despite falling #differentials over the last several months, this level has not been reached and does not seem likely to be reached.

There are other reasons why a coffee might be certified as well though. In fact, tenderable parity is relatively rare and yet we still see increases in certified coffee periodically.

One of those is financing.

The trade likes holding certified inventory because banks like certified inventory as collateral. Since certified coffee is very liquid collateral, it is an easy way for the trade to increase their financing.

However, it is also possible that the tenderable parity trap has been sidestepped by taking cheap older coffees that cup well and submitting them to be certified. I have no evidence that this is taking place other than the origins that we see change in the certified inventory, and rumors that the cup quality of the new certs is kind of past-croppy.

Again, I'm not making any accusations or judgments but merely trying to make sense of what has happened, so I submit this as a hypothesis.

What's Coming

Whatever the cause, the implications of calendar spreads moving to carry are huge because it signals the full transition of a market going from bull to bear.

The spec correlation with price has reached a whopping 95% over the past 6 months which shows how important it is to anticipate their movement. Until recently, the inversion had been holding the specs back from a full short position.

Now that the market is no longer inverted, it signals the end of a bull market to specs, and more importantly, it also actually incentivizes specs to go short.

With a carry market, the short position collects the same roll-yield that the trade does for being short. This actively increases the P&L of specs who are short and this in part contributed to the massive Spec Short positions in 2018.

The specs had already started going short, but now it adds further potential.

[I'm old school. I don't believe in this Freemium nonsense. If something is worth money, I pay for it. Good market reports cost money, that's why I have a premium subscription from Coffee Trading Academy.]

Here is a brief study showing the potential from one of my #COT posts a few weeks ago:

"If the specs go net short in Arabica there is a LOT of bearish potential. For comparison, in the bear market of 2018-202, the specs went to a low net short of over 100k lots. Since specs are currently still net LONG of 2k, this means that there are potentially 100k lots of selling to be done.

To put some numbers on this, we can estimate COT spec movements as having roughly a 0.01c (1 basis point) move per lot. This means that if the specs go MAX SHORT (-100k short), we can expect prices to drop ~100c.

On Tuesday, the market was 185, so 10c down from there would be 85c. This coincides with the rough lows of the market, so it makes some sense.

We do have to prepare for the eventuality that the specs will go max short...but not anytime soon. To reach max short, I think that we will need to see a carry trade in the calendar spreads combined with weak fundamentals."

My main caveat to reaching these lows which was the lack of a carry market. This impediment is now out of the way and so there is quite a bit of bearish potential.

Is there no Hope?

This might seem very bearish, but the influence of the spec is also their achilles heel.

If the market becomes too one-sided by the shorts and too undervalued, we will get a specific chain of events:

1) the producer will stop selling, 2) the roaster and the trade will both start buying 3) the spec will be forced to cover.

This chain of events has happened before and it will happen again. This bear market doesn't look like its done yet, but it is important to note that the deeper the spec gets into a short position the more vulnerable they will become to a rally. The spec logs learned this lesson as well when the dramatic sell-offs.

Our estimation is that prices have now dipped from being overvalued to undervalued, but this is typical of strongly trending bull and bear markets. As specs and emotions take over, the market often shoots models to both the upside and the downside.

[I'm a trader, I believe in win/win. Sign for a free trial of our premium content to get value for you and show your support for independent research. That's win/win homie.]

There are still potential problems out there. There are indications that the 23 Brazil crop has had a poor setting and may harvest a worse crop than many expected. The Colombian crop has been improving but still facing struggles.

Most notably for the bulls, the #USD which has been so dramatically bearish for commodities for so long, has also faced a dramatic turn around. If this sell off in USD continues, it could be very bullish commodities.

For now, even in spite of dollar weakness, coffee continues to fall. This is perhaps telling of sentiment and bearish momentum.

The certs are still a bit of a mystery, until the coffee is graded we won't know exactly what is in the pending stocks, and we still don't know how much more is coming. However, the current trend is one of higher stocks and a market returning to carry.

The carry market is good news for the #trade, but even better news for short specs. If the #specs decide to return to max short, then the potential for new lows is great.

[We hope you found this of value. If you did, you will love our premium subscriptions. It's where the good stuff is. ]

Comments